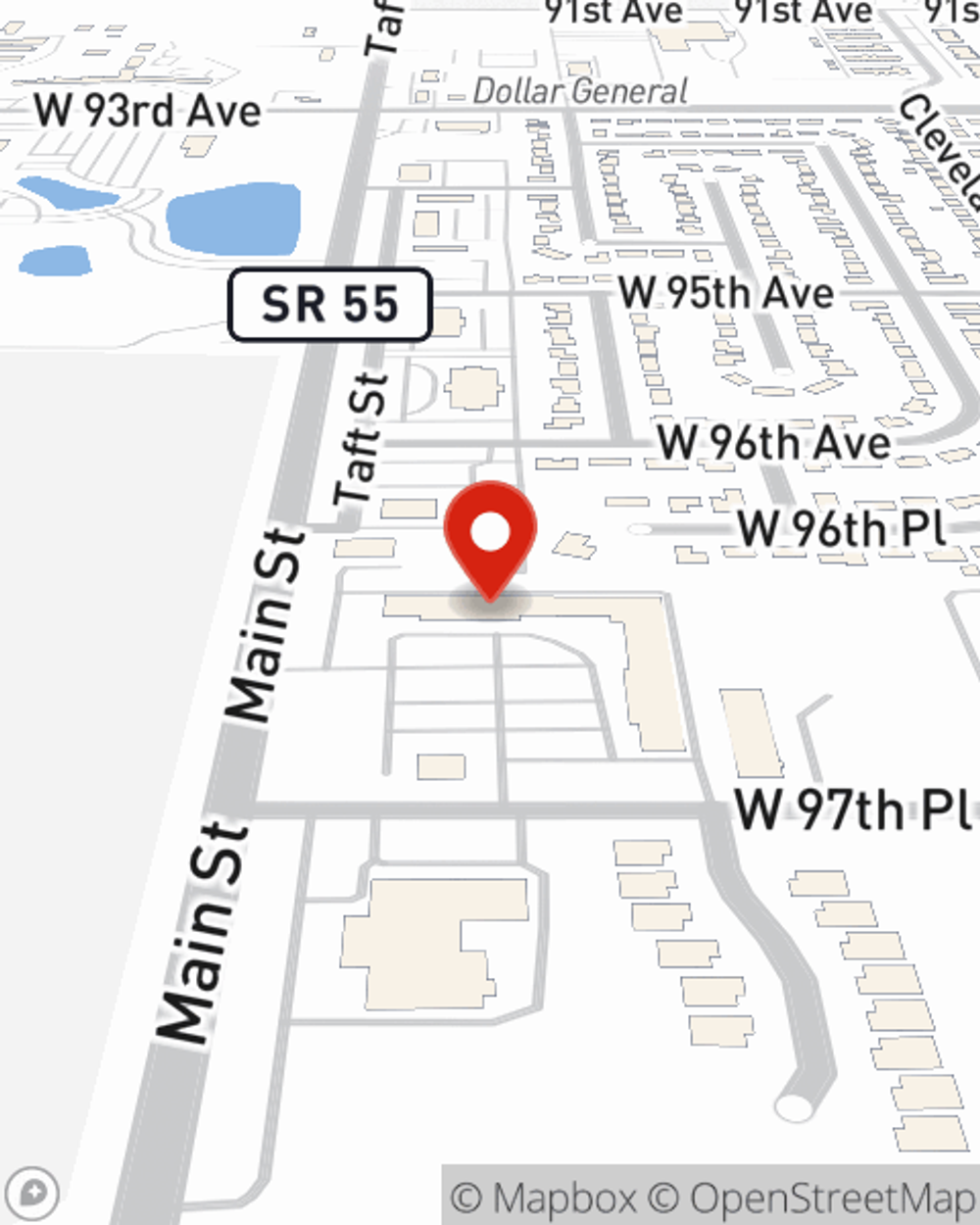

Homeowners Insurance in and around Crown Point

Looking for homeowners insurance in Crown Point?

Help cover your home

Would you like to create a personalized homeowners quote?

- Schererville, IN

- Merrillville, IN

- St John, IN

- Indianapolis, IN

- Chicago, IL

- Munster, IN

- Valparaiso, IN

- Hammond, IN

- Dyer, IN

- South Bend, IN

- Palatine, IL

- Naperville, IL

- Arlington Heights,IL

- Lansing, IL

- Calumet City, IL

- Cedar Lake, IN

- Highland, IN

- Griffith, IN

- Hobart, IN

- Evansville, IN

- Demotte, IN

Home Is Where Your Heart Is

You want your home to be a place to laugh and play after a long day. That doesn't happen when you're worrying about getting your lawn mowed, and especially if you don't have homeowners insurance. That's why you need us at State Farm, so all you have to worry about is the first part.

Looking for homeowners insurance in Crown Point?

Help cover your home

Don't Sweat The Small Stuff, We've Got You Covered.

Aaron Pinkus will help you feel right at home by getting you set up with great insurance that fits your needs. State Farm's coverage for your home not only covers the structure of your home, but can also protect valuable items like your mementos.

Don’t let concerns about your home keep you up at night! Call or email State Farm Agent Aaron Pinkus today and explore how you can benefit from State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Aaron at (219) 663-9000 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to protect a vacant house after moving

How to protect a vacant house after moving

If your former home hasn't sold, your vacant home could fall victim to potentially costly issues. Consider these tips for vacant property protection.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Aaron Pinkus

State Farm® Insurance AgentSimple Insights®

How to protect a vacant house after moving

How to protect a vacant house after moving

If your former home hasn't sold, your vacant home could fall victim to potentially costly issues. Consider these tips for vacant property protection.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.