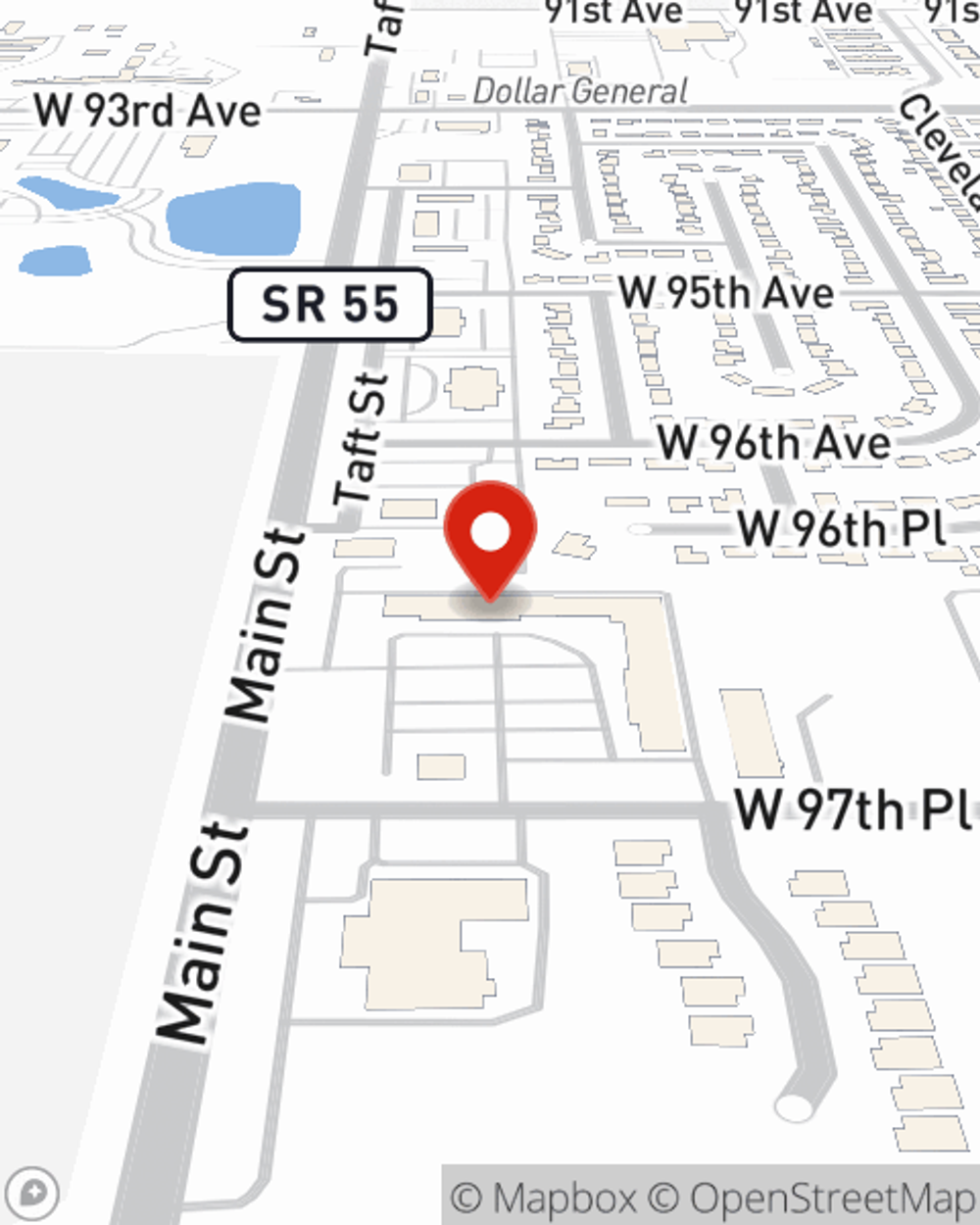

Business Insurance in and around Crown Point

Get your Crown Point business covered, right here!

Helping insure businesses can be the neighborly thing to do

- Schererville, IN

- Merrillville, IN

- St John, IN

- Indianapolis, IN

- Chicago, IL

- Munster, IN

- Valparaiso, IN

- Hammond, IN

- Dyer, IN

- South Bend, IN

- Palatine, IL

- Naperville, IL

- Arlington Heights,IL

- Lansing, IL

- Calumet City, IL

- Cedar Lake, IN

- Highland, IN

- Griffith, IN

- Hobart, IN

- Evansville, IN

- Demotte, IN

This Coverage Is Worth It.

When you're a business owner, there's so much to remember. You're not alone. State Farm agent Aaron Pinkus is a business owner, too. Let Aaron Pinkus help you make sure that your business is properly protected. You won't regret it!

Get your Crown Point business covered, right here!

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

For your small business, whether it's an antique store, a toy store, an appliance store, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like business property, business liability, and equipment breakdown.

It's time to reach out to State Farm agent Aaron Pinkus. You'll quickly perceive why State Farm is one of the leaders in small business insurance.

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Aaron Pinkus

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.